Chưa có sản phẩm trong giỏ hàng.

How To Calculate Cost of Goods Sold COGS

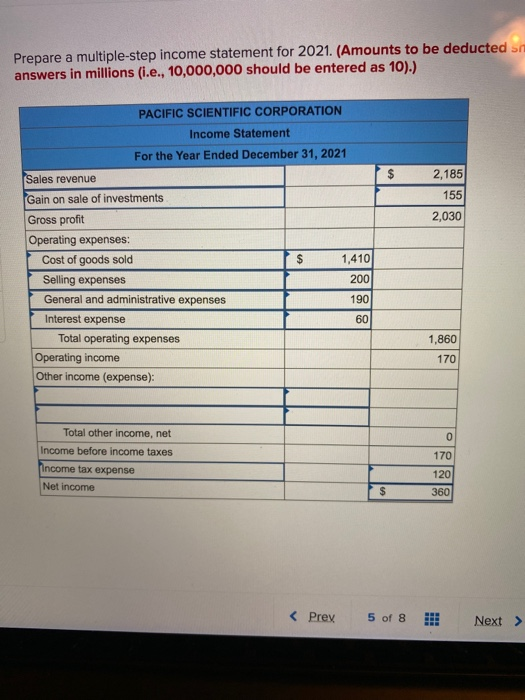

In service-oriented businesses, where direct costs of services (like labor) may not be as clearly definable as in manufacturing, COGS becomes a less effective metric. In these cases, comprehensive cost accounting methods that can allocate overhead and administrative costs more accurately are more informative. Operating expenses (OPEX) and cost of goods sold (COGS) are separate sets of expenditures incurred by businesses in running their daily operations. Consequently, their values are recorded as different line items on a company’s income statement.

Get in Touch With a Financial Advisor

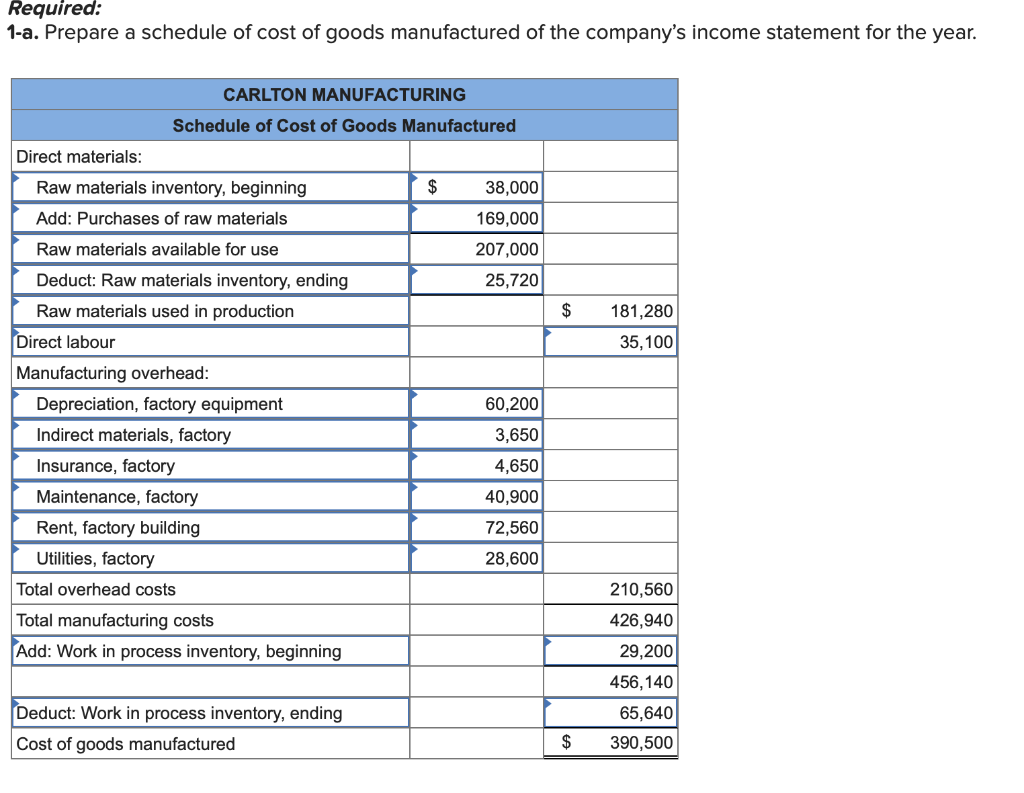

If you’re a manufacturer, you need to have an understanding of your cost of goods sold, and how to calculate it, in order to determine if your business is profitable. Here are the five steps for calculating COGS, then fill in our Cost of Goods Sold Calculator with your own data. It typically reduces the inventory account and increases the cost of goods sold expense account. In a perpetual inventory system the cost of goods sold is continually compiled over time as goods are sold to customers.

Are Salaries Included in COGS?

Importantly, COGS is based only on the costs that are directly utilized in producing that revenue, such as the company’s inventory or labor costs that can be attributed to specific sales. By contrast, fixed costs such as managerial salaries, rent, and utilities are not included in COGS. Inventory is a particularly important component of COGS, and accounting rules permit several different approaches for how to include it in the calculation. The costs included in the cost of goods sold are essentially any costs incurred to produce the goods being sold by a business. The most likely costs to be included within this category are direct labor, raw materials, freight-in costs, purchase allowances, and factory overhead. The factory overhead classification includes manufacturing and materials management salaries, as well as all utilities, rent, insurance, and other costs related to the production facility.

Cost of Goods Sold for Service Businesses

Naturally, these changes have the potential to affect the costs of goods sold (COGS) in multiple ways. In the realm of business finance, the accuracy of COGS calculations cannot be overstated. When COGS is computed with precision, it informs several key aspects of a business’s financial decision-making. Step on down the path with us as we explore the calculations required in determining costs of goods sold (COGS). Finance Strategists has an advertising relationship with some of the companies included on this website.

Do you own a business?

- A similar average cost is also used for the number of items sold in the previous accounting period to reveal COGS.

- But other service companies—sometimes known as pure service companies—will not record COGS at all.

- The balance sheet has an account called the current assets account.

- Throughout Year 1, the retailer purchases $10 million in additional inventory and fails to sell $5 million in inventory.

And when tax season rolls around, having accurate records of COGS can help you and your accountant file your taxes properly. Determining the cost of goods sold is only one portion of your business’s operations. But understanding COGS can help you better understand your business’s financial health.

FIFO Method

Basing your pricing strategy on precise COGS will ensure your selling price covers all production costs and brings in a sufficient profit margin. Without an accurate understanding of COGS, a business could undervalue their goods leading to financial are salaries part of cost of good sold loss or overvalue them, hurting competitiveness. Moreover, inaccurately classifying costs can also impact the calculation of a company’s overhead rate. This rate is typically used to allocate indirect costs to products or projects.

Operating expenses refer to expenditures that are not directly tied to the production of goods or services, such as rent, utilities, office supplies, and legal costs. Cost of goods sold (COGS) refers to expenses directly related to the production and sale of a company’s goods and services. It includes all variable costs, such as raw materials, labor costs, and electricity costs that increase directly with the volume of output.

Understating COGS can inflate a company’s profit, painting an inaccurate picture of its financial health. Overstating it, on the other hand, can cause the business to appear less profitable than it is. This can have serious implications, affecting a company’s reputation and stock price. It also facilitates compliance with regulatory standards by maintaining accurate accounting records. There are also some cases that businesses, specifically service companies, do not have COGS and inventories, thus, no COGS are displayed on their respective income statements. Cost tracking is essential in calculating the correct profit margin of an item.

If five units are sold and the company charges the first group of five to expense, then the cost of goods sold is $50. However, if the second group is charged to expense, then the cost of goods sold doubles, to $100. Depending on which method is used, the ending inventory balance will change. Because of this issue, several approaches have been developed to derive the cost of goods sold, as outlined below.

Understanding your inventory valuation helps you calculate your cost of goods sold and your business profitability. The cost of goods sold and cost of sales refer to the same calculation. Both determine how much a company spent to produce their sold goods or services.