Chưa có sản phẩm trong giỏ hàng.

How operating expenses and cost of goods sold differ?

To find the COGS, a company must find the value of its inventory at the beginning of the year, which is the value of inventory at the end of the previous year. When you hire us, you will be treated with care during every step of the process. On Schedule C on the 1040, wages paid to employees of your self-employed business are deducted on line 26. You’ll need to sign in or create an account to connect with an expert. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Capital Rationing: How Companies Manage Limited Resources

- During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount.

- COGS represents the cost of the inventory that has been sold during a period and thus reduces a company’s profits.

- In a retail or wholesale business, the cost of goods sold is likely to be merchandise that was bought from a manufacturer.

Conversely, underestimating direct costs, i.e., understating COGS, can produce a deceptive image of higher profitability. The misinterpretation of such crucial financial performance indicators may lead to misguided business decisions. Before we end this section, it’s crucial to remember that the costs of goods sold does not include indirect expenses like distribution costs and sales force costs.

Get in Touch With a Financial Advisor

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Let’s say there’s a clothing retail store that starts off Year 1 with $25 million in beginning inventory, which is the ending inventory balance from the prior year. The cost of goods sold is an important metric for a number of reasons. Now that we have understood the calculation of COGS, let’s take a look at its importance in business. The cost of goods made or bought adjusts according to changes in inventory. For example, if 500 units are made or bought, but inventory rises by 50 units, then the cost of 450 units is the COGS.

Energy and Utility Management

However, only do so if the reduction will not impact the customer experience; after all, reducing costs that also lead to a decline in sales will worsen profits. Cost of Goods Sold (COGS), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or services. COGS is an essential part of your company’s profit and loss statements, one of the most crucial financial documents for any growing business. Profit and loss statements, which are also called income statements, list your revenue and expenses to calculate your net profit.

What is beginning inventory in relation to COGS?

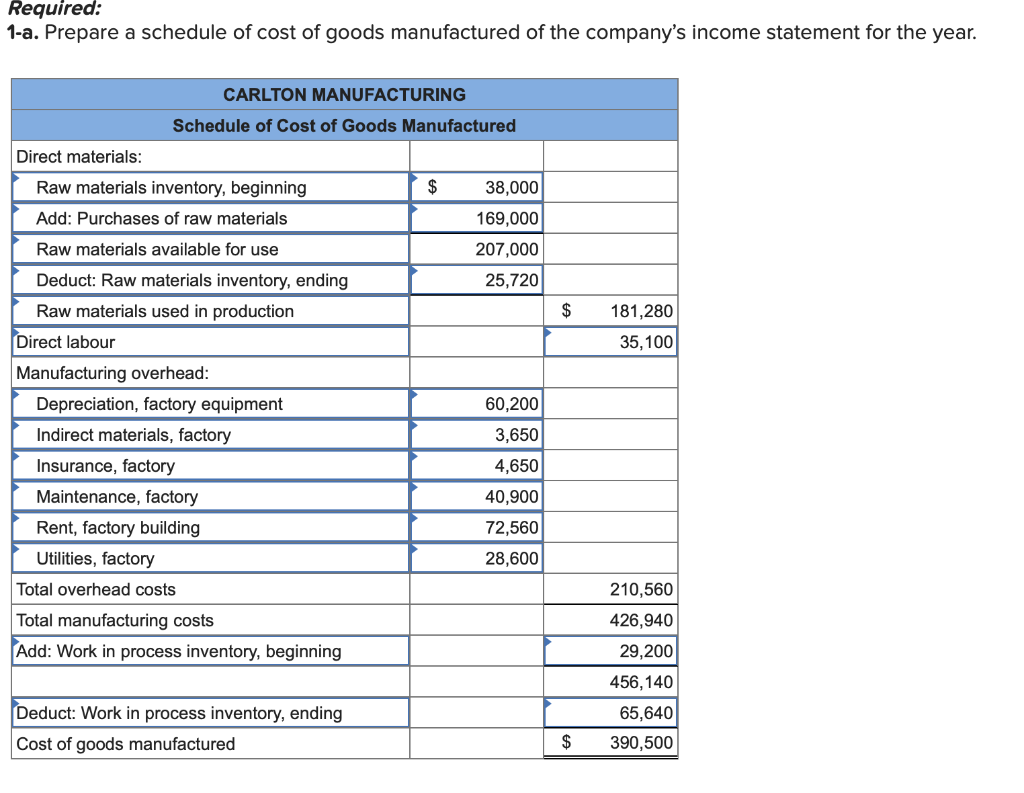

The cost of direct materials can be calculated by taking your beginning direct materials, adding your purchased materials, and subtracting your ending direct materials from the two. They are recorded as different line items in the income statement, but both are subtracted from the revenue or total sales. A similar average cost is also used for the number of items sold in the previous accounting period to reveal COGS. The average cost method, or weighted-average method, does not take into consideration price inflation or deflation.

For instance, a company may need to pay rent, utilities, and marketing costs regardless of the number of goods produced or sold during a given period. Cost of goods sold is the term used for manufacturers on their costs spent to produce a product. Cost of sales is typically used by service-only businesses because they cannot list COGS on their income statements. Examples of businesses using the cost of sales are business consultants, attorneys, and doctors. This includes direct labor cost, direct material cost, and direct factory overheads.

For example, sole proprietors and LLCs need to use a Schedule C, while an S corporation needs to include COGS in Form 1120 or Form 1120-S. They implement responsible supply chain management by using recycled polyester in their production process. Although their initial costs increased due to this choice, the company saw long-term savings because they require less raw material and consume less energy in their production process. One substantial way sustainable practices can impact COGS is by reducing waste during the production process. Overproduction, defective production, and transportation issues can contribute to material waste and increased costs. By implementing a sustainability policy focused on lean manufacturing—that is, producing only what is needed and when it’s needed—companies can counteract this issue.

Instead, COGS is reported on the income statement and directly affects the inventory figures which are shown on the balance sheet. The balance sheet reflects the ending inventory, which is directly influenced by the COGS calculation. If an item has an easily identifiable are salaries part of cost of good sold cost, the business may use the average costing method. However, some items’ cost may not be easily identified or may be too closely intermingled, such as when making bulk batches of items. In these cases, the IRS recommends either FIFO or LIFO costing methods.