Chưa có sản phẩm trong giỏ hàng.

Are Officers’ Salaries COGS or Overhead Expenses?

Unlike COGS, which focuses on the past, marginal cost can help a business plan for the future. It aids in optimizing cost-efficiency, productivity, and profitability by informing decisions around production quantity and pricing. You should consider marginal cost when dealing with questions of scaling, introducing a new product, or changing product volumes. In economics and business strategy, marginal cost and cost of goods sold (COGS) are key components in determining pricing and profitability.

What Type of Companies Are Excluded From a COGS Deduction?

On the income statement, the cost of goods sold (COGS) line item is the first expense following revenue (i.e. the “top line”). Make sure to run the equation frequently to ensure your business is comfortably in the black or, if not, show you what changes you need to make to boost your profitability. If you don’t just sell goods but also assemble raw materials to create goods, your inventory will include all the building blocks that make up your final product. For example, if you own a smoothie food truck, the cost of your frozen fruit would count as inventory. Variable costs are costs that change from one time period to another, often changing in tandem with sales.

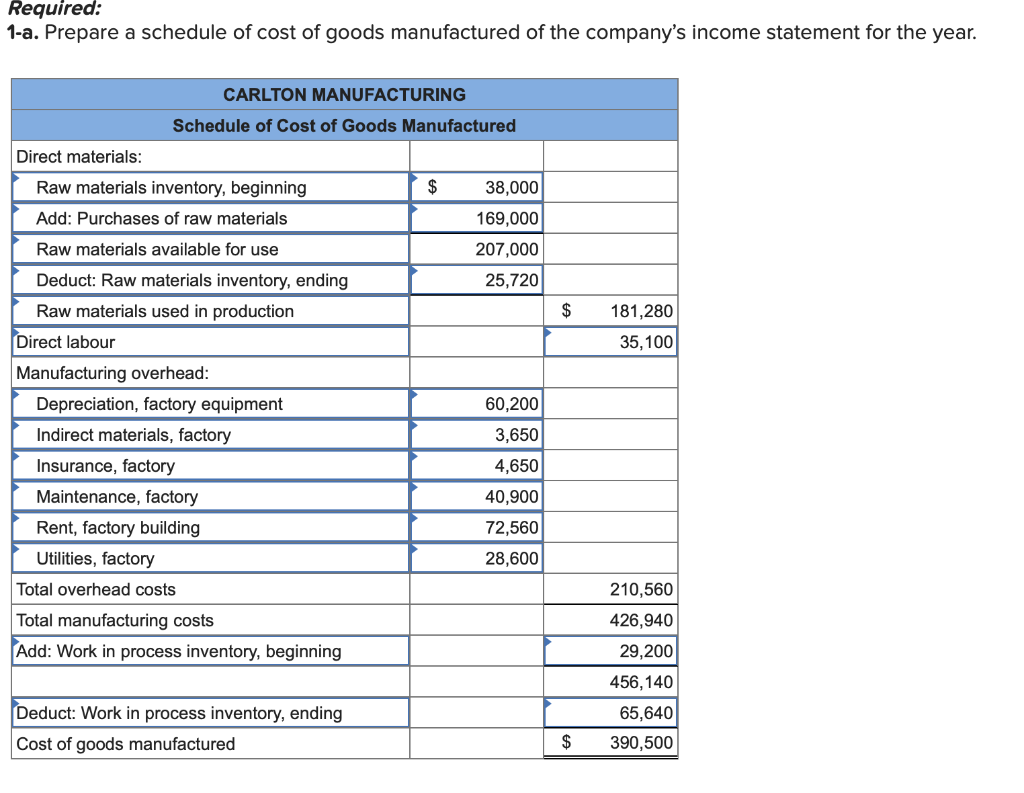

Indirect Costs (Manufacturing Overhead Costs)

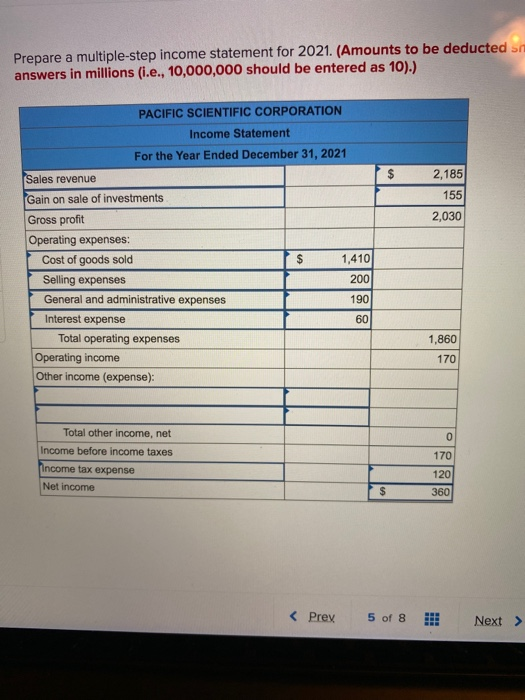

For multi-step income statements, subtract the cost of goods sold from sales. You can then deduct other expenses from gross profits to determine your company’s net income. It can be helpful to think of cost of goods sold as expenses you wouldn’t otherwise have if you hadn’t performed the service or produced the product. This includes direct costs (like raw materials, merchandise for resale, and packaging) and indirect costs (like the labor required to create the product and costs to store the products). Conversely, if it’s something you would purchase whether you have one or one hundred clients (like office space or a software subscription), it doesn’t count as a cost of goods sold.

Manufacturing Overhead

It does not include any general, selling, or administrative costs of running a business. Direct expenses are directly linked to a company’s primary operations, specifically the purchase, production, and sale of goods or services. They are variable costs that fluctuate with the speed of production and are monitored by the respective department managers. Examples of direct expenses include raw materials, labour costs, manufacturing expenses, transportation costs, and import duties.

Direct Labor

On the other hand, if you underestimate your COGS, your gross profit will appear larger and result in you paying more tax than necessary. Therefore, your business must strive to maintain precise bookkeeping practices and calculations. Toyota is a prime example of a company that has incorporated lean manufacturing.

How is COGS calculated?

Understanding these components helps businesses accurately calculate COGS. This, in turn, will help you in setting product prices, managing inventory, and assessing overall profitability. The revenue generated by a business minus its COGS is equal to its gross profit. Higher COGS with disproportionate pricing can leave your business in a deficit position if the prices are too low or alienate consumers if the price is too high. COGS include market-driven costs like lumber, metal, plastic, and other supplies that have a cost set by someone else and are, therefore, less under your control. It helps you set prices, determine if you need to change suppliers, and identify profit loss margins.

- We will also include examples to help you understand the process of calculating the cost of goods sold.

- COGS includes the direct costs of producing a good, such as raw materials, labour, and taxes, as well as indirect costs like administrative expenses, rent, and utilities.

- Using FIFO, the jeweler would list COGS as $100, regardless of the price it cost at the end of the production cycle.

- Instead, the average price of stocked items, regardless of purchase date, is used to value sold items.

- For multi-step income statements, subtract the cost of goods sold from sales.

It is subtracted from a company’s revenue to determine its gross profit. For other business structures, the deduction still applies but might be reported in different forms corresponding to their tax filing requirements. The IRS guidelines on COGS allow businesses to include the cost of products or raw materials, direct labor costs involved in production, and factory overhead in their calculations. You should record the cost of goods sold as a business expense on your income statement. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. You can determine net income by subtracting expenses (including COGS) from revenues.

The phrase “overhead expenses” generally refers to the broad category of expenses incurred by a company during the course of daily operations. Overhead expenses can include items such as advertising, utilities and rent, and office supplies and wages. These expenses also apply to both a company’s tax forms and a profit and loss statement.

It’s subtracted from a company’s total revenue to get the gross profit. Cost of Goods Sold (COGS) is the direct cost of a product to a distributor, manufacturer, or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. When a company pays an officer a salary, that salary must be accounted for on both the company’s financial statements and the company’s tax return at the close of the year.

FIFO and specific identification track a single item from start to finish. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, and professional dancers, among others. are salaries part of cost of good sold Even though all of these industries have business expenses and normally spend money to provide their services, they do not list COGS. Instead, they have what is called “cost of services,” which does not count towards a COGS deduction.

You also have to spend $1 per bath soap on the labor required to craft it and $1 for packaging. To produce a bath soap, your company has to spend approximately $5 per soap on ingredients such as soap base, fragrance, and additives. I’m here to help you with removing handling the accounts on your reports or income and expenses. Twitty’s Books began its 2018 fiscal year with $330,000 in sellable inventory.