Chưa có sản phẩm trong giỏ hàng.

Cost of Goods Sold COGS Explained With Methods to Calculate It

Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. Although an officer’s salary is clearly never part of the cost of goods sold, the IRS has specific rules regarding how to report an officer’s salary. While most officer salaries are considered to be wages, some situations arise in which an officer’s salary is not considered to be wages. The structure of the company, the duties of the officer, and the amount paid to the officer can be important considerations when determining how to report an officer’s salary for tax purposes.

Is the cost of goods sold an expense?

This approach does no reflect actual usage patterns in most cases, and so is banned by the international financial reporting standards. The gross profit helps determine the portion of revenue that can be used for operating expenses (OpEx) as well as non-operating expenses like interest expense and taxes. The FIFO method assumes the first goods produced or purchased are the first sold, whereas the LIFO method assumes the most recent products produced or purchased are the first sold. The average cost method uses the average cost of inventory without regard to when the products were made or purchased.

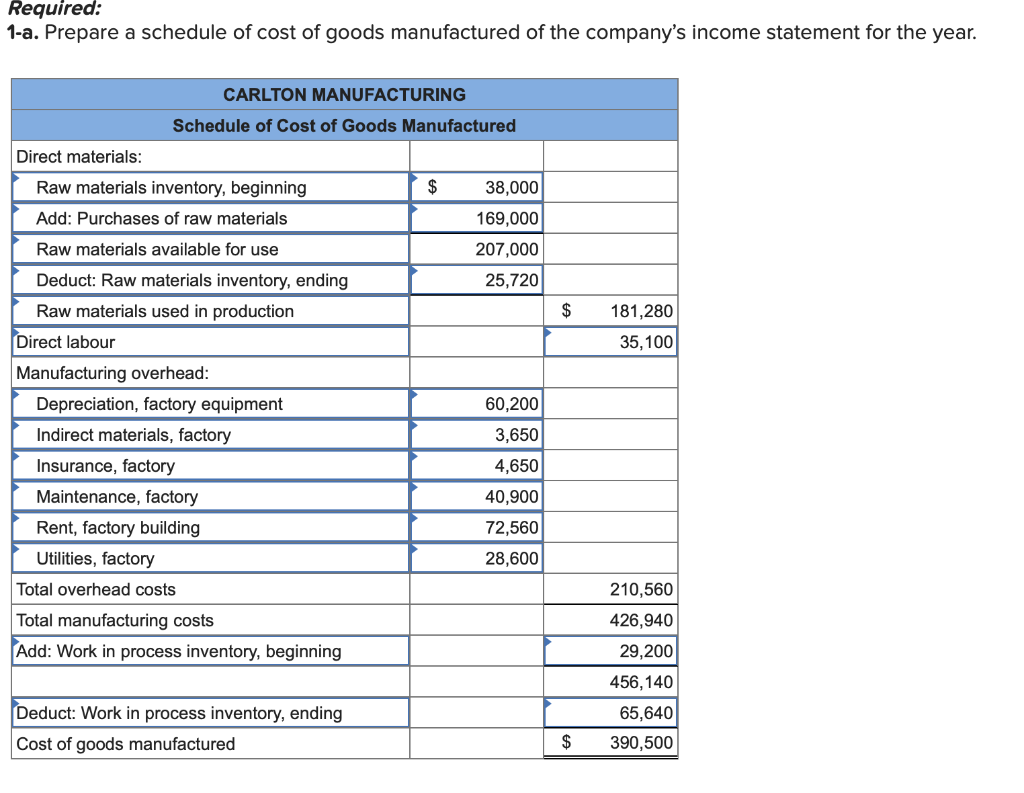

Overhead Expenses

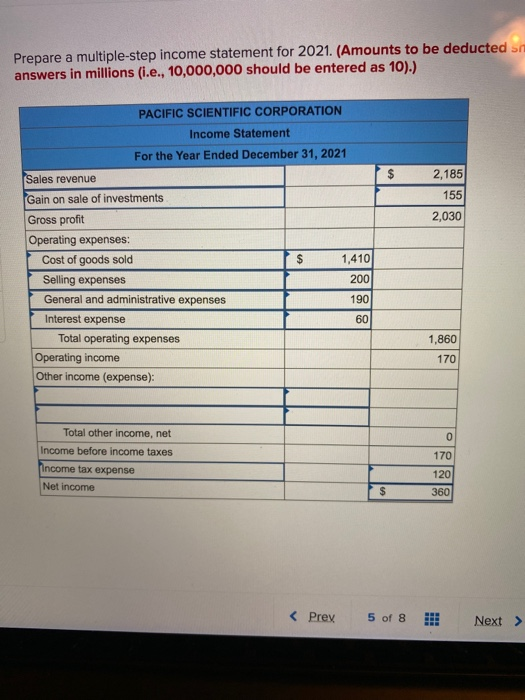

Any costs that directly relate to selling your product should be considered part of your cost of goods sold. For example, if you pay employees to assemble your product, both the product’s raw materials and the employees’ are salaries part of cost of good sold wages are included in your cost of goods sold. These expenses are also known as direct expenses since they relate directly to your product’s creation. Multi-step profit and loss statements are a little more complicated.

- Additionally, the ending inventory is inflated because the latest inventory was purchased at higher prices.

- In these cases, comprehensive cost accounting methods that can allocate overhead and administrative costs more accurately are more informative.

- By subtracting the annual cost of goods sold from your annual revenue, you can determine your annual profits.

- In an inflationary environment, this means that the most expensive (newest) inventory items are charged to expense first, which tends to minimize the reported profit level.

Cost of goods sold: How to calculate and record COGS

Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position. For example, COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. If COGS is under-reported, it will artificially inflate the profit margin, painting a picture of profitability that may not be fully accurate.

The special identification method uses the specific cost of each unit of merchandise (also called inventory or goods) to calculate the ending inventory and COGS for each period. In this method, a business knows precisely which item was sold and the exact cost. Further, this method is typically used in industries that sell unique items like cars, real estate, and rare and precious jewels. The balance sheet has an account called the current assets account. The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory.

By the end of 2018, Twitty’s Books had $440,000 in sellable inventory. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. You will often have some administration costs that often require some analysis, but sales is always a “black or white” classification. The closing inventory refers to any goods still in stock at the end of your chosen period. You need to subtract this number from your opening inventory and total purchases to get your COGS figure.

To calculate it, add the beginning inventory value to the additional inventory cost and subtract the ending inventory value. Consumers often check price tags to determine if the item they want to buy fits their budget. But businesses also have to consider the costs of the product they make, only in a different way. Then your (beginning inventory) + (purchases) – (ending inventory) would result in a negative. Most service businesses—like freelance writers, graphic designers, career coaches, and the like—have little to no costs of goods sold. That’s because the things they need to do their work, like computer hardware and software, remains the same no matter how many pieces of work they create.

You’d simply add up how much it cost to acquire each product and, voilà, you’ve found your beginning inventory’s total value. Finally, the business’s inventory value subtracts from the beginning value and costs. This will provide the e-commerce site with the exact cost of goods sold for its business. Then, the cost to produce its jewellery throughout the year adds to the starting value. These costs could include raw material costs, labour costs, and shipping of jewellery to consumers.